Challenge:

Solution:

Outcome:

Challenge:

In 2017, this regional bank with over $200 Billion in assets under management approached G2O with a specific challenge: to help transform their account origination experience to meet the demand of digital natives and drive more organic online sales to support its growth goals.

Although it had robust internal technology and data and analytics teams, they lacked the internal CX expertise and resources to ensure a strategic solution that truly centered on customer needs. The bank sought out a trusted banking consulting partner to provide resources with deep CX and UX skills, who could seamlessly integrate with their teams, quickly grasp their core values, and help deliver outcomes for this project and beyond.

Solution:

The G2O team developed a strategic UX solution based on thorough customer research to transform the client’s account origination automation process. The new platform was launched successfully, significantly boosting new organic online sales and supporting the bank’s growth goals.

The success of this initial solution and the trusted partnership formed through it demonstrated the ongoing need and value of having this CX expertise added to the team. The client recognized the importance of continuous access to these skills to ensure their digital transformation efforts consistently delivered meaningful value to customers and increased loyalty.

As the client’s trusted expert, G2O provided seasoned consultants to fill skill gaps in areas including:

- Journey Mapping

- Service Blueprinting

- Digital UX Design

- Content & Communication Strategy

- Change Management

G2O’s comprehensive understanding of banking operations and UX team development enabled us to seamlessly integrate into the client’s operations, participate in partner meetings to guide vendor selection, and build out the client’s internal UX capabilities for long-term success.

Outcome:

G2O’s Partnerships Over Projects approach empowered our client to continually launch customer and employee experience enhancements, distinguishing themselves from their competition along the way.

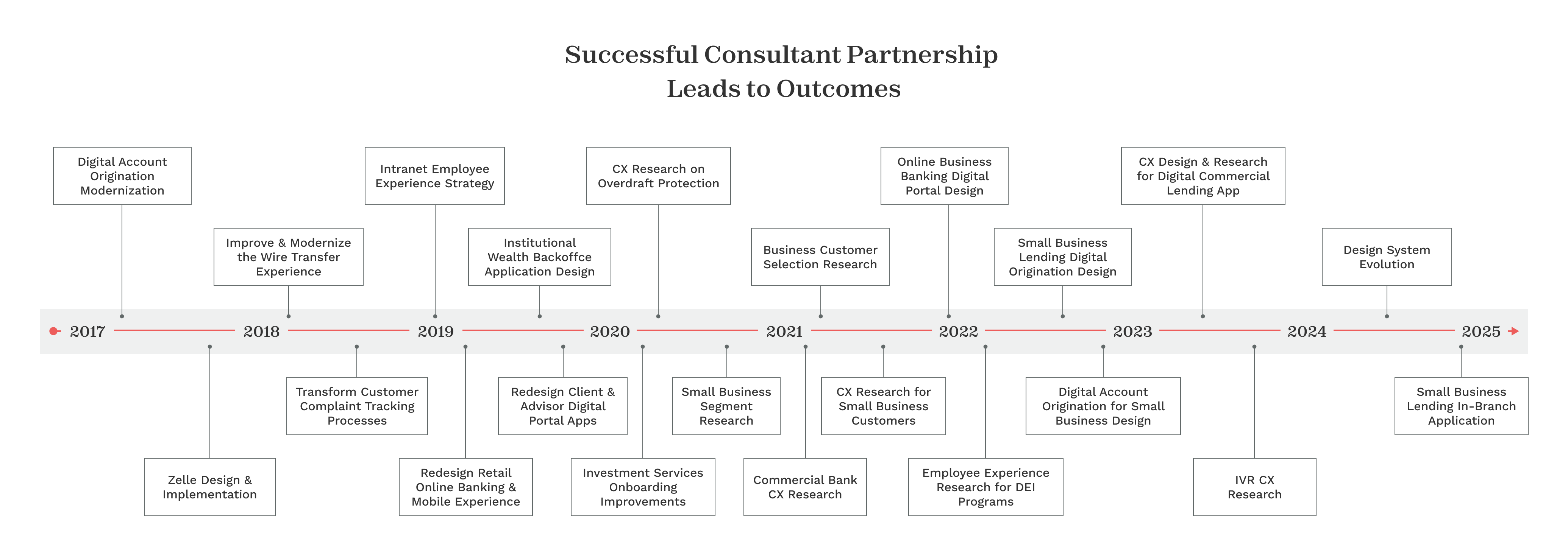

To elevate their digital transformation initiative, the G2O team undertook 20+ strategic projects to enhance user experiences across various touchpoints. In addition to our digital product design and UX work, G2O established teams focused on improving the CX and UX across various other parts of the business. Project highlights include:

Institutional Wealth Backoffice Application Design

Redesign of the wealth management portals for both advisors and clients was validated through a combination of G2O’s rigorous user testing and customer feedback collection and evaluation, while organizational capabilities were strengthened by providing dedicated product management, content, and design resources to improve the client’s design system.

Improve & Modernize the Wire Transfer Experience

To improve the client’s customer service during a wire transfer, the G2O team conducted audits and discovery work to enhance the overall wire transfer experience. The initiative included creating a detailed playbook for implementing and maintaining a redesigned intranet experience, all focused on improved usability for internal stakeholders.

Customer Complaint Handling

Identifying, logging, dispositioning, tracking and ultimately responding and resolving problems expressed by customers defined as a disappointment on how a particular experience or service transaction happened is a daily challenge for banks to manage. We helped our client, and multiple other banks, improve the internal complaint tracking and management process leveraging human centered design methodologies that have resulted in improved internal efficiency and ultimately higher levels of customer satisfaction.

Our partnership over the years has provided our client with quick and consistent access to resources, ensuring they have the right skills in place to tackle every new Customer Experience touchpoint they want to elevate.

Today, we’re proud of the relationship we’ve built with our client through various CX and UX initiatives as a trusted banking consultant partner. Customer expectations never stop evolving. Neither should your bank.

Get in touch to see how your team can benefit from this type of consulting partnership. >