Challenge:

Solution:

Outcome:

In a world where customer service is king, banks are no exception. In fact, providing top-tier service is not only expected, it’s a necessity in order for financial institutions to thrive.

Yet as banks grow and expand their operations and audiences, maintaining the same level of personalized service becomes increasingly difficult. This often becomes a delicate balancing act, with the pressure to scale offerings for commercial customers and meet other demands of a growing institution.

For one regional bank with historic ties to the community, becoming the bank of choice for commercial customers meant taking a closer look at personalized service with the realities of a larger, more complex organization.

Challenge:

With the recent acquisition of another financial institution, this regional bank was poised to grow its operations and expand its reach to new markets. With a clear goal of becoming a $40 billion bank within the next three to five years, the bank focused on enhancing its product offerings and improving its customer service to attract and retain more commercial customers.

The bank aims to become the financial partner of commercial customers by prioritizing their needs, offering tailored solutions and expert advice to help them achieve their business goals. Through this strategic plan, the bank set the goal of solidifying its position as a leading financial institution and establishing itself as the commercial customers’ bank of choice.

White glove service goes above and beyond the standard level of customer service, with dedicated relationship managers providing tailored financial advice and assistance. For decades, this financial institution has been known for its high level of attention to detail and service. With growth in its sights, could the bank continue its track record of differentiating itself from competitors and continuing to attract and retain loyal customers?

To do so, the banking institution would need to break down internal silos and leverage digital tools to elevate its customer experience while still maintaining its already strong reputation for client satisfaction.

Solution:

The bank partnered with G2O to build a solid customer experience foundation by understanding various customer journeys, developing a strategic roadmap and aligning internal stakeholders. By unifying around the customer and prioritizing their needs from the ground up, the client also recognized the opportunity to proactively define a self-service experience that positioned itself as a trusted business partner – one that is invested in the success and growth of its commercial clients.

Combining our expertise in Experience, Technology and Data and Analytics, G2O created a six-month research and project plan that would reimagine the future service experiences for the client’s commercial customers. This plan included strategic value and tactical approaches to create a full-service model.

Examining current state:

Creating benchmarks:

Directing to a North Star:

Outcome:

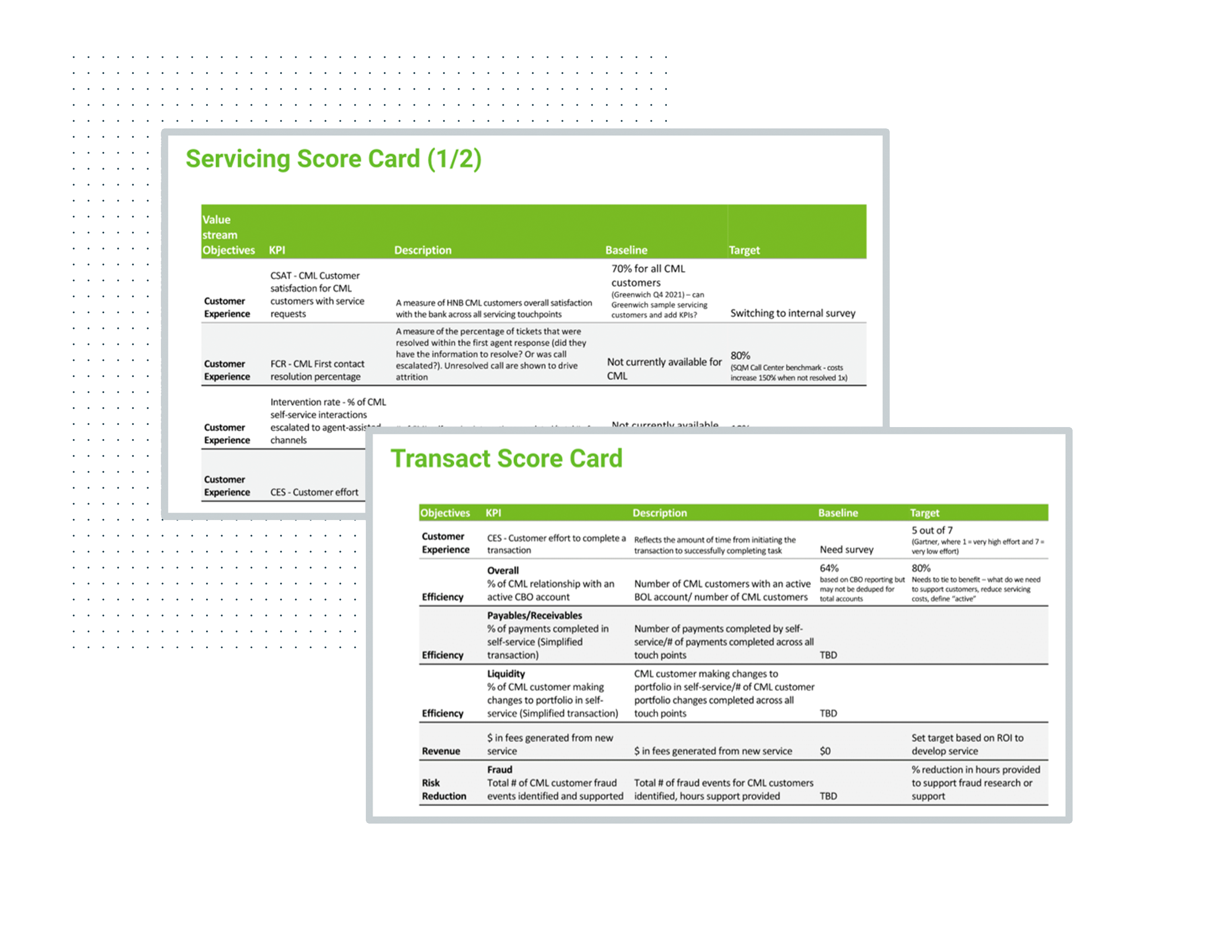

G2O provided a multi-year strategic roadmap outlining the highest value initiatives with baseline metrics to track success. Each initiative provided detailed Journeys and Scorecards that illustrated the performance impact of the recommendations, outlining corresponding benefits such as operational efficiencies, call volume reduction and improved associate retention.

Workshops held with stakeholders along the way further enhanced understanding and encouraged adoption of the new strategies among client associates, the “heroes,” who would deliver on these goals.

This strategic work now guides Phase Two, where tactical roadmaps will be created to lead the execution.

Beyond just a deliverable, G2O’s partnership and process aligned the organization toward future goals and priorities, and united the teams toward the tactical implementation of its Customer Experience Transformation.